觀點類大作文,社會(hui) 類話題

It is important for everyone, including young people, to save money for their future. To what extent do you agree or disagree with this statement?

題目來源:劍19Test3大作文

1、題目大意

每個(ge) 人,包括年輕人,都應該為(wei) 自己的未來存錢。你在多大程度上同意或不同意這一說法?

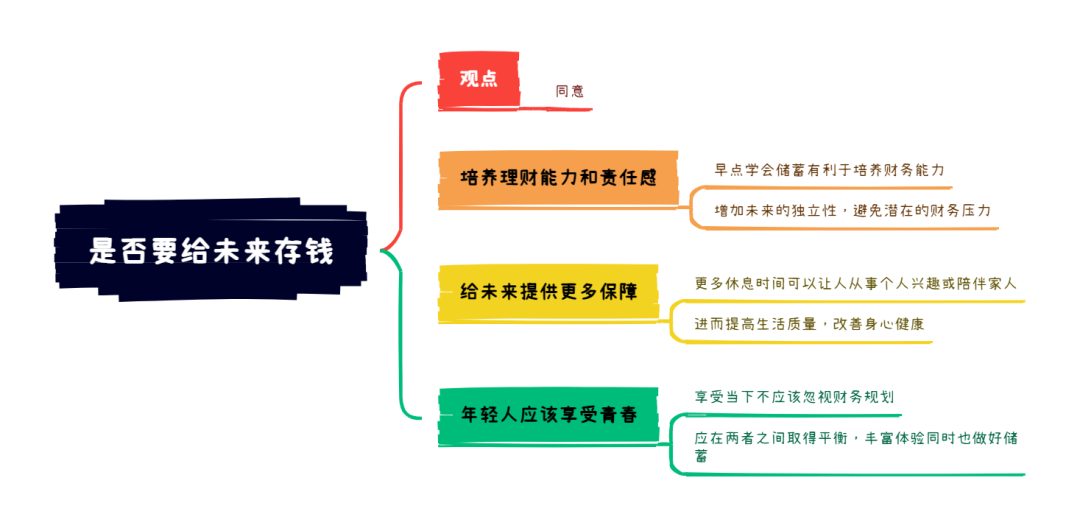

2、思路解析

這是一道觀點類大作文,聊的是要不要存錢,審題是注意兩(liang) 點,一是題目明確提到了“young people”這個(ge) 群體(ti) ,在論證中需要考慮到。二是明確指出了存錢的目的是“for the future”,需要從(cong) 這個(ge) 角度出發展開。下麵,王珍老師帶大家一起來看下具體(ti) 觀點。

首先來看讚同的角度,有三方麵。

一是存錢可以幫助個(ge) 人應對未來可能出現的緊急情況或突發事件,例如失業(ye) 、疾病或養(yang) 老。提前存錢可以確保在這些情況下有足夠的資金應對,減少經濟壓力,保障生活質量。

二是年輕人存錢可以幫助他們(men) 實現長期目標,如買(mai) 房、創業(ye) 或接受更多教育和培訓。通過積累儲(chu) 蓄,他們(men) 可以離達成目標更近一步,而不需要依賴貸款或其他形式的債(zhai) 務,從(cong) 而減少經濟負擔。

三是從(cong) 年輕時開始存錢有助於(yu) 培養(yang) 良好的財務習(xi) 慣,這些習(xi) 慣將伴隨人們(men) 的一生。有了這項技能,個(ge) 人可以在在未來更好地規劃和管理自己的財務,提高經濟獨立性和安全感。

再來看反對的角度,同樣可以有三個(ge) 角度

一是年輕人應該把錢花在當下的自我發展上,例如教育、培訓和旅行,以積累知識和經驗,提高自己的競爭(zheng) 力和綜合素質。這些投資可能比單純存錢帶來的長期回報更大,有助於(yu) 他們(men) 在職業(ye) 生涯中獲得更高的收入和更好的發展機會(hui) 。

二是年輕人正處於(yu) 人生的探索階段,追求即時滿足感和快樂(le) 也是重要的生活體(ti) 驗。過度強調存錢可能讓他們(men) 錯過很多值得體(ti) 驗的美好事物和機會(hui) ,例如旅行、社交活動和興(xing) 趣愛好,這些都是豐(feng) 富人生經曆的重要部分。

三是年輕人的消費對經濟增長有積極作用。通過購買(mai) 商品和服務,他們(men) 可以推動市場需求,促進經濟發展。如果所有人都傾(qing) 向於(yu) 存錢而不是消費,可能會(hui) 導致經濟停滯和市場蕭條,影響整體(ti) 社會(hui) 的繁榮。

3、提綱

4、高分範文示例

In today's society, the importance of financial planning and saving for the future cannot be overstated, particularly for young individuals. I firmly agree that everyone, including young people, should prioritize saving money to ensure financial stability and security in the long term.

Firstly, developing the habit of saving money from a young age instils financial discipline and responsibility. Young people who learn to save early are better equipped to manage their finances as they grow older. This financial acumen helps them avoid the pitfalls of debt and unnecessary expenditures, fostering a sense of independence and self-sufficiency. For instance, a young adult with a savings account is less likely to rely on credit cards or loans for unexpected expenses, thereby avoiding high interest rates and potential financial strain.

Moreover, saving money early provides a safety net for future uncertainties and opportunities. Life is unpredictable, and having a financial cushion can alleviate stress during times of crisis, such as unemployment, medical emergencies, or economic downturns. Additionally, having savings can open doors to opportunities that require financial investment, such as higher education, starting a business, or purchasing property. For example, a young individual with substantial savings can afford to pursue advanced degrees or entrepreneurial ventures without the burden of overwhelming debt.

On the other hand, some might argue that young people should focus on enjoying their youth and spending money on experiences rather than saving. While it is important to enjoy life and gain valuable experiences, this perspective overlooks the long-term benefits of financial planning. Striking a balance between enjoying the present and preparing for the future is crucial. Young people can still partake in enriching experiences while setting aside a portion of their income for savings. This balanced approach ensures they do not compromise their future financial security for short-term gratification.

In conclusion, the practice of saving money from a young age is essential for ensuring financial stability, independence, and preparedness for life's uncertainties and opportunities. By prioritizing savings, young individuals can build a secure financial foundation that will benefit them throughout their lives.

5、相關(guan) 詞匯和語法結構

saving for the future 為(wei) 未來儲(chu) 蓄

financial stability 財務穩定

manage their finances 管理他們(men) 的財務

instills discipline 灌輸紀律

financial acumen 財務敏銳度

avoid the pitfalls of debt 避免債(zhai) 務陷阱

unnecessary expenditures 不必要的開支

sense of independence 獨立感

Self-sufficiency 自給自足

safety net for future uncertainties 未來不確定性的安全網

alleviate stress 緩解壓力

economic downturns 經濟衰退

overwhelming debt 巨額債(zhai) 務

long-term benefits 長期利益

developing the habit 養(yang) 成習(xi) 慣

sense of independence 獨立感

unnecessary expenditures 不必要的開支

alleviate stress 緩解壓力

![外交學專(zhuan) 業(ye) ]準研家長掌握5大科研提升秘籍](https://img.abigailspetspa.com/wp-content/uploads/2025/03/1743155967-10-1743155967.jpeg)

評論已經被關(guan) 閉。